20+ Cagr Calculation Formulas In Excel: The Ultimate Guide To Mastering Your Financial Growth

Calculating the Compound Annual Growth Rate (CAGR) is a fundamental concept in finance and investment, offering insights into the performance of investments over a specified period. In this comprehensive guide, we will delve into the world of CAGR calculations in Excel, exploring various formulas and techniques to master your financial growth analysis. Whether you're an investor, analyst, or financial enthusiast, this guide will provide you with the tools to make informed decisions and track the performance of your investments effectively.

Understanding CAGR and Its Significance

CAGR is a powerful metric used to measure the average annual growth rate of an investment or a portfolio. It smoothens out the fluctuations in returns and provides a clear picture of the investment's overall performance. By calculating CAGR, you can compare the growth of different investments over time, make informed decisions, and set realistic expectations for your financial goals.

The formula for CAGR is relatively straightforward: CAGR = (Ending Value / Starting Value)^(1/Number of Years) - 1. However, Excel provides a range of functions and tools that can simplify the calculation process and offer more advanced insights.

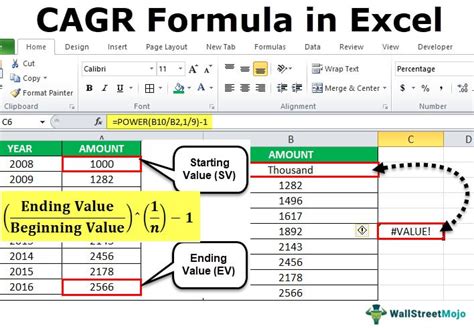

Basic CAGR Calculation in Excel

Let's start with the fundamental approach to calculating CAGR in Excel. This method involves manually inputting the starting value, ending value, and the number of years into the formula.

CAGR = (Ending Value / Starting Value)^(1/Number of Years) - 1

For example, if you have an investment with a starting value of $10,000 and an ending value of $15,000 over a period of 3 years, the CAGR can be calculated as follows:

CAGR = (15000 / 10000)^(1/3) - 1

CAGR = 1.1447 - 1

CAGR = 0.1447 or 14.47%

This basic calculation provides a simple understanding of the investment's average annual growth rate.

Using Excel Functions for CAGR Calculation

Excel offers a range of functions that can streamline the CAGR calculation process and handle more complex scenarios. Here are some essential functions to master:

1. POWER Function

The POWER function in Excel raises a number to a specified power. It can be used to calculate the CAGR by raising the ratio of the ending value to the starting value to the power of 1/Number of Years.

=POWER(Ending Value / Starting Value, 1/Number of Years) - 1

This function simplifies the calculation and ensures accuracy, especially when dealing with large datasets.

2. RATE Function

The RATE function calculates the interest rate per period of an annuity. While it is primarily used for interest rate calculations, it can also be applied to CAGR calculations by treating the investment as an annuity with periodic returns.

=RATE(Number of Years, -Periodic Return, Starting Value)

Here, the Periodic Return is the difference between the ending value and the starting value divided by the number of years.

3. IRR Function

The IRR (Internal Rate of Return) function calculates the internal rate of return for a series of cash flows. Although it is commonly used for project analysis, it can also be adapted for CAGR calculations. By inputting the cash flows as the difference between the ending and starting values, you can obtain the CAGR.

=IRR(Cash Flows, Guess)

In this case, the Cash Flows would be the difference between the ending and starting values for each year, and Guess is an optional argument to provide an initial estimate for the IRR.

Advanced CAGR Calculations

Beyond the basic and function-based calculations, there are advanced techniques to handle more complex scenarios and provide a comprehensive analysis of your investments.

1. Adjusting for Inflation

When calculating CAGR, it is essential to consider the impact of inflation on investment returns. By adjusting the starting and ending values for inflation, you can obtain a more accurate representation of the investment's real growth rate.

To adjust for inflation, you can use the following formula:

Adjusted CAGR = (Ending Value / Starting Value)^(1/Number of Years) - Inflation Rate

Here, the Inflation Rate is the average annual inflation rate over the investment period.

2. Calculating CAGR with Non-Annual Periods

CAGR calculations are not limited to annual periods. You can adapt the formula to calculate CAGR for monthly, quarterly, or semi-annual periods. To do this, you need to adjust the number of years accordingly.

For example, if you have quarterly data for a 4-year period, the number of years would be 4*4 = 16. The formula would then become:

CAGR = (Ending Value / Starting Value)^(1/16) - 1

3. Handling Irregular Intervals

In some cases, you may have investments with irregular intervals, such as investments made at different times throughout the year. To calculate CAGR for such scenarios, you can use the XIRR function in Excel.

=XIRR(Cash Flows, Dates, Guess)

Here, Cash Flows are the differences between the ending and starting values, and Dates represent the dates of each investment. The Guess argument is an optional estimate for the internal rate of return.

Visualizing CAGR with Charts and Graphs

Excel offers a range of charting and graphing tools to visualize your CAGR calculations and provide a clearer understanding of your investment's performance.

1. Line Charts

Line charts are an excellent way to visualize the growth of your investment over time. You can plot the starting and ending values on the y-axis and the years on the x-axis to create a visual representation of the CAGR.

2. Scatter Plots

Scatter plots are useful for comparing the performance of multiple investments or portfolios. By plotting the CAGR values for different investments on the y-axis and a unique identifier (e.g., investment name) on the x-axis, you can visually compare their growth rates.

3. Area Charts

Area charts can be used to illustrate the cumulative growth of your investment over time. By plotting the cumulative values on the y-axis and the years on the x-axis, you can create a visual representation of the investment's overall performance.

Tips and Best Practices for CAGR Calculation

To ensure accurate and reliable CAGR calculations, consider the following tips and best practices:

- Use consistent data sources and ensure data integrity.

- Verify the accuracy of your starting and ending values.

- Consider the impact of inflation and adjust your calculations accordingly.

- Handle non-annual periods and irregular intervals appropriately.

- Use Excel's built-in functions and tools to streamline your calculations.

- Visualize your results with charts and graphs for better understanding.

Conclusion

Mastering CAGR calculations in Excel is a valuable skill for investors, analysts, and financial enthusiasts. By understanding the different formulas and techniques, you can gain insights into the performance of your investments and make informed decisions. Remember to adapt your calculations to different scenarios, consider inflation, and visualize your results to gain a comprehensive understanding of your financial growth.

With the knowledge and tools provided in this guide, you are well-equipped to analyze and track the performance of your investments, leading to better financial management and growth.

FAQ

How does CAGR differ from simple annual growth rate calculations?

+CAGR smoothens out the fluctuations in returns over a period, providing an average annual growth rate. Simple annual growth rate calculations, on the other hand, consider only the starting and ending values without accounting for the time period.

Can I calculate CAGR for negative starting or ending values?

+No, CAGR calculations require positive starting and ending values. Negative values can lead to inaccurate results and should be avoided.

What if I have missing data points in my investment history?

+If you have missing data points, it is best to estimate the missing values based on historical trends or consult with a financial expert. Accurate data is crucial for reliable CAGR calculations.

How can I compare the performance of multiple investments using CAGR?

+You can use scatter plots or line charts to visually compare the CAGR values of different investments. This allows you to identify the investment with the highest growth rate and make informed decisions.

Is it possible to calculate CAGR for investments with irregular intervals or non-annual periods?

+Yes, you can calculate CAGR for irregular intervals or non-annual periods by adjusting the number of years accordingly. Excel’s XIRR function can also be used to handle such scenarios.